Regional Income Tax: A Complete Guide to Understanding Local Taxation Systems

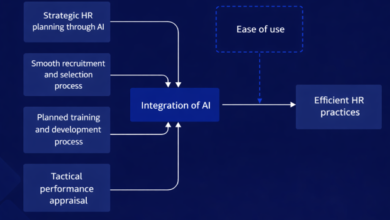

Introduction to Regional Income Tax

Regional income tax is a form of taxation imposed by regional or local authorities rather than the central or federal government. This system allows regions, states, provinces, or municipalities to collect revenue based on the income of individuals or businesses within their jurisdiction. The approach is designed to provide local governments with financial independence and resources to manage public services such as healthcare, education, and infrastructure.

Understanding regional income tax is essential for taxpayers, businesses, and financial planners to ensure compliance and to make informed financial decisions. This article provides a detailed breakdown of how regional income tax works, examples from different countries, and its advantages and challenges.

What Is Regional Income Tax?

Regional income tax refers to an additional tax imposed on earned income by a regional authority. It is usually calculated as a percentage of taxable income, sometimes in addition to national income taxes.

This system is common in countries where regional governments have autonomy to manage their finances. The rates and structures often differ across regions, creating variability in the tax burden.

Why Regional Income Tax Exists

Revenue for Local Governments

Regional taxes are a primary source of revenue for local administrations to fund public services such as:

-

Maintenance of regional roads and public transport

-

Local schools and universities

-

Healthcare facilities

-

Regional development projects

Decentralized Governance

By empowering local authorities to manage taxation, regions gain more control over economic planning and resource allocation.

Examples of Regional Income Tax Systems

Italy

In Italy, individuals pay a national income tax (IRPEF), and regions add their own surcharge. Regional income tax rates typically range from 0.7% to 3.33%, while municipalities can impose an additional 0.1% to 0.9%. This layered approach allows both national and local governments to share revenue responsibilities.

Spain

Spain operates a unique model where personal income tax (IRPF) is split between the national government and autonomous regions. Regions have the authority to adjust rates, deductions, and credits. For example:

-

Madrid maintains some of the lowest regional tax rates.

-

Catalonia imposes higher rates, particularly on top earners.

Scotland, United Kingdom

Scotland sets its own income tax bands and rates for earned income, while savings and investment income remains under the UK government. The Scottish system has five tax bands, with a top rate of 48%, higher than the rest of the UK. This revenue supports devolved services like education and healthcare.

Sweden

Sweden collects income tax at three levels: municipal, county, and national. Municipal taxes typically make up a significant portion of total income tax, reflecting the country’s emphasis on local welfare services.

Pakistan

In provinces like Sindh, agricultural income is taxed at the regional level. The rates vary based on income levels, with exemptions for smaller earners and higher rates for corporate farming operations. Other regions, like Gilgit-Baltistan, offer tax exemptions to stimulate economic activity.

How Regional Income Tax Is Calculated

Step 1: Determine Taxable Income

Taxable income includes salaries, business profits, and sometimes certain allowances. Some regions may exclude specific income categories.

Step 2: Apply Regional Tax Rate

Each region has its own rates and brackets. For example:

-

In Italy, if your taxable income is €40,000 and the regional rate is 2%, the regional tax would be €800.

Step 3: Consider Additional Surcharges

Some regions or municipalities may impose additional taxes on top of the regional income tax.

Benefits of Regional Income Tax

Local Revenue Generation

Regional income tax enables local governments to independently generate revenue, reducing reliance on central funding.

Improved Local Services

Funds collected are often reinvested directly into local infrastructure and services, creating a visible impact on residents’ quality of life.

Tailored Economic Policies

Regions can adjust tax policies to fit their unique economic and social conditions, encouraging balanced development.

Challenges of Regional Income Tax

Complexity in Compliance

Multiple tax rates and rules across regions can create confusion for taxpayers and businesses, especially those operating in multiple jurisdictions.

Economic Disparities

Regions with lower tax rates may attract more businesses and residents, while higher-tax regions risk losing talent and investment.

Administrative Burden

Managing and enforcing tax compliance at multiple levels requires robust systems and efficient coordination between regional and central tax authorities.

Impact on Businesses

Businesses operating in multiple regions face additional administrative tasks, including:

-

Registering with regional tax authorities

-

Filing separate tax returns

-

Keeping track of varying rates and deadlines

For multinational companies, understanding these differences is critical to avoid penalties and optimize tax planning.

Strategies for Managing Regional Income Tax

Stay Informed

Regularly check regional government announcements for updates on tax rates, exemptions, or filing requirements.

Use Professional Tax Advisors

Engaging tax professionals with regional expertise can simplify compliance and identify potential savings.

Plan for Tax Variability

Incorporate regional tax differences into budgeting and financial forecasts, especially when expanding into new regions.

Future Trends in Regional Income Tax

Digital Tax Administration

Many regions are adopting digital systems for registration, filing, and payments to streamline processes and improve transparency.

Greater Autonomy

With ongoing decentralization in several countries, more regions may gain authority to adjust income tax rates, further differentiating regional tax landscapes.

Focus on Fairness and Sustainability

Governments are exploring progressive structures and targeted exemptions to ensure equitable taxation while supporting economic growth.

Conclusion

Regional income tax is an essential component of modern taxation systems, promoting financial independence for local governments and enabling tailored economic strategies. While it brings advantages like improved local services and revenue generation, it also introduces complexity for taxpayers and businesses.

By staying informed, seeking professional guidance, and planning effectively, individuals and businesses can navigate regional tax systems smoothly. As digital tools and decentralized governance continue to evolve, regional income tax will remain a significant factor in shaping economic policy and development worldwide.