David Martinez Businessman Behind Global Financial Influence

David Martinez businessman—a phrase that might not ring as many bells as Elon Musk or Warren Buffett, but within the world of global finance, it speaks volumes. Known for his quiet demeanor, elusive presence, and extraordinary investing acumen, David Martinez has built a financial empire through calculated risks and brilliant plays in distressed debt and sovereign restructuring. While he avoids media limelight, his business footprint spans continents and billion-dollar transactions.

This article dives deep into the life, career, strategies, and impact of David Martinez, a silent force in international finance.

Early Life and Educational Journey

From Monterrey to Harvard

David Martinez was born in 1957 in Monterrey, Mexico, into a family that valued education and discipline. He initially pursued electrical engineering at the prestigious Monterrey Institute of Technology and Higher Education (ITESM), where he laid the foundation of his analytical and strategic thinking.

After a brief spiritual exploration in Rome, where he studied at the Pontifical Gregorian University with intentions of becoming a priest, Martinez changed his path. He later earned an MBA from the Harvard Business School, one of the most elite institutions in the world. This education sharpened his skills and exposed him to global finance trends that would shape his future.

The Rise of Fintech Advisory Inc.

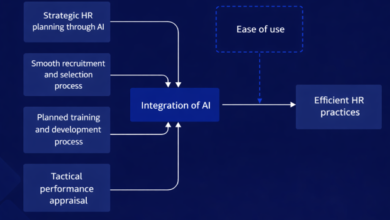

A Silent Giant in Distressed Investing

David Martinez founded Fintech Advisory Inc. in the late 1980s. The company quickly earned a reputation for thriving in distressed-debt markets—a sector that requires patience, deep financial knowledge, and nerves of steel.

Fintech’s unique approach involves acquiring deeply undervalued assets and working through legal, political, and economic complexities to restructure and profit. The firm’s model is based on long-term strategy, not short-term wins, and this has made Martinez a go-to figure in high-stakes financial negotiations.

Major Business Moves

Argentina and Sovereign Debt

One of Martinez’s most defining contributions came through his work in Argentina. When the country defaulted on its debt, most investors fled. Martinez saw an opportunity. Through Fintech, he acquired large amounts of sovereign bonds, often at a steep discount, and later played a critical role in negotiations that led to profitable restructuring deals.

Telecom Argentina and Cablevisión

Fintech was also pivotal in Argentina’s telecom and media sectors. Martinez bought into Cablevisión, one of the country’s largest media groups, and played a part in its eventual merger with Telecom Argentina. This deal alone was valued at nearly $1 billion, cementing his position as a heavyweight in the region.

Mexican Media Ventures

In 2024, David Martinez made headlines again by acquiring a significant stake in Grupo Televisa, Mexico’s media giant. This move is believed to reflect not only his confidence in Latin America’s media sector but also his strategic vision in consolidating influence across industries.

Global Presence and Influence

Banking in Spain

Martinez extended his reach to Europe during the post-crisis era by acquiring shares in Banco Sabadell, one of Spain’s leading banks. His ability to see value where others saw risk allowed him to make impactful decisions and become a major shareholder.

Mexican Airports Deal

Another bold move came with his investment in Grupo Aeroportuario del Centro Norte (OMA), which manages several airports across Mexico. In 2023, he sold this stake for over $800 million, generating substantial profits.

Personal Life and Public Persona

The Art Collector

Despite his extreme wealth, David Martinez maintains an extraordinarily low profile. He rarely gives interviews or makes public appearances. However, he is known for his impressive art collection, which includes works by Rothko, Picasso, and Damien Hirst.

He also resides in an opulent apartment in New York City’s Time Warner Center, rumored to be worth over $40 million. But unlike many billionaires, Martinez avoids ostentatious displays of wealth, choosing instead a life behind the scenes.

Controversies and Criticism

Regulatory Issues

Like many power players in finance, Martinez hasn’t escaped scrutiny. At one point, he was fined by Spanish regulators for failing to properly disclose significant holdings in Banco Sabadell. Moreover, his complex web of offshore companies has raised eyebrows among transparency advocates.

Political Allegiances

Martinez has also been linked to various political figures in Latin America, particularly in Argentina. His close ties with the Kirchner administration have led to speculation that his business dealings may be influenced by political favors. However, no legal charges have ever been filed against him.

Business Philosophy and Legacy

Patience and Precision

David Martinez’s success lies not in aggressive expansion but in calculated precision. He invests where others retreat, often navigating through legal battles and political minefields to come out on top. His contrarian strategy has made him one of the most respected and secretive financiers in the world.

Long-Term Impact

Martinez’s influence stretches far beyond profits. He has played a central role in restructuring economies, saving companies from collapse, and shaping the business landscape of entire countries. His style is a testament to what long-term vision and strategic patience can achieve.

Conclusion

David Martinez businessman is a term that encapsulates more than just wealth—it defines a mindset, a strategy, and a legacy of silent power. While many billionaires chase media attention, Martinez has built a global empire from the shadows. His story is one of intellect, discipline, and quiet dominance in a world often driven by noise.

Whether dealing with sovereign debt in South America or media conglomerates in Mexico, David Martinez continues to be a powerful force in shaping international finance—one discreet move at a time.