morrisons cash deposit atms: A Complete 2025 Guide to the UK’s Fastest-Growing Cash Deposit Network

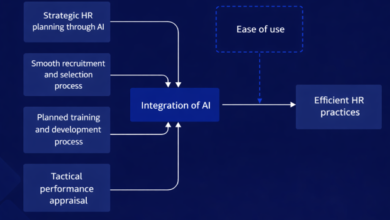

Cash access in the United Kingdom has changed rapidly over the past decade, with thousands of bank branches closing and communities struggling to access essential cash services. In response to this gap, major UK supermarkets started offering financial services through in-store ATMs. Among these, Morrisons has emerged as the largest non-bank cash deposit ATM provider, revolutionising how people deposit money conveniently while shopping.

This article provides a complete, SEO-optimised 1000-word guide to morrisons cash deposit atms, including how they work, what banks they support, benefits, security, and insights into the broader morrisons cash deposit atm rollout across the country.

Understanding Morrisons Cash Deposit ATMs

Morrisons cash deposit ATMs allow customers to both withdraw and deposit notes directly into their bank accounts using their debit cards. Unlike traditional cash machines that only dispense money, these upgraded machines support full cash-in functionality similar to bank branch counters.

Why Morrisons Introduced Deposit Machines

The supermarket recognised a major need in the UK:

-

Thousands of bank closures reduced access to cash services.

-

Many rural and suburban communities no longer had a local branch.

-

Businesses needed quick and safe deposit options.

-

Customers demanded greater financial convenience without travelling long distances.

Morrisons stepped in to fill this gap by partnering with leading ATM operators and cash-service networks to create a nationwide deposit infrastructure.

The Rise of the Morrisons Cash Deposit ATM Network

Morrisons became the largest non-bank operator of cash-deposit ATMs in the UK. This growth has been part of a strategic national effort to keep cash accessible, especially for vulnerable groups and cash-reliant communities.

The Morrisons Cash Deposit ATM Rollout

One of the most significant developments has been the rapid expansion of deposit-enabled machines across Morrisons stores.

Key Features of the Rollout

-

Installation of 40+ deposit ATMs, with numbers increasing continuously.

-

Placement in high-footfall supermarkets, ensuring easy access.

-

Focus on towns where bank branches have closed.

-

Deployment in partnership with major ATM and cash-service providers.

This rollout is part of a national initiative supported by banks and cash-access organisations to maintain a functioning cash ecosystem in the UK.

How Morrisons Cash Deposit ATMs Work

Step-by-Step Process

-

Insert your debit card.

-

Enter your PIN securely.

-

Select “Deposit Cash” from the on-screen options.

-

Insert your banknotes into the deposit slot.

-

Confirm the amount shown on the screen.

-

Receive a printed receipt confirming your deposit.

-

Funds are typically credited immediately or within minutes.

Morrisons deposit machines currently accept banknotes only — coins are not supported.

Banks Supported by Morrisons Deposit ATMs

One of the biggest advantages of Morrisons deposit ATMs is the wide compatibility with UK banks. Most major banking brands support cash deposits at these machines.

Common Supported Banks

-

Barclays

-

Lloyds

-

Halifax

-

Bank of Scotland

-

HSBC

-

NatWest

-

Royal Bank of Scotland

-

Santander

-

TSB

-

Virgin Money

-

Ulster Bank

Support can vary slightly by location, but in most stores, the majority of UK debit cards are accepted.

Benefits of Using Morrisons Cash Deposit ATMs

Convenience Beyond Banking Hours

Traditional banks close early, but Morrisons stores often open late. This allows customers to deposit cash at convenient times, even after work or during weekends.

Ideal for Small Businesses

Local business owners — such as shopkeepers, salon owners, market traders, and takeaway operators — commonly use these machines to deposit daily earnings safely.

Free to Use

For most bank customers, Morrisons deposit ATMs are completely free of charge, providing cost-effective access to cash services.

Faster Processing

Deposits at Morrisons ATMs are typically credited instantly, reducing the need to wait for branch processing times.

Security and Safety Measures

Secure Technology

Morrisons ATMs are equipped with:

-

Advanced anti-fraud software

-

Secure PIN encryption

-

Real-time cash validation

-

CCTV coverage for user protection

Reduced Risk for Businesses

Depositing cash more frequently reduces the risk of theft and eliminates the need to store large amounts of cash overnight.

Why Morrisons Cash Deposit ATMs Matter for the UK

Supporting Cash-Dependent Communities

Despite digital banking growth, millions of UK residents still rely heavily on cash. Deposit ATMs in supermarkets bridge the gap left by bank closures.

Strengthening Local Economies

By making deposits easier, Morrisons supports the financial stability of small businesses and local traders.

Keeping Cash Alive

Cash remains essential for:

-

Elderly individuals

-

Low-income households

-

Rural communities

-

People with disabilities

Morrisons ATMs promote financial inclusion by keeping cash accessible.

The Future of Morrisons Cash Deposit Services

Continued Expansion Expected

With the success of the initial deployment, Morrisons is expected to install more deposit ATMs across its stores in 2025 and beyond.

Integration With Banking Innovations

Future upgrades may include:

-

Coin deposit options

-

Contactless card features

-

Digital receipts via email

-

Enhanced business deposit services

The supermarket is positioning itself as a key contributor to the UK’s cash-access infrastructure.

Conclusion

Morrisons has transformed how people access banking services by introducing a widespread network of morrisons cash deposit atms. Through strategic investment and a consumer-focused rollout, the supermarket now offers one of the most convenient, reliable, and accessible ways to deposit cash in the UK.

With the ongoing morrisons cash deposit atm rollout, more communities will gain access to essential banking services, supporting individuals, small businesses, and local economies alike. Morrisons’ initiative demonstrates that supermarkets can play a powerful role in improving financial inclusion and making everyday life easier for millions of people.