Adverse Media Screening: A Vital Tool in Risk Management

Introduction

Adverse media screening plays a crucial role in modern compliance and risk management programs. As regulations become stricter and financial crimes more sophisticated, businesses must stay ahead by leveraging technology to detect and avoid association with individuals or entities involved in illicit activity. In this article, we examine the significance of adverse media screening, its operational mechanics, and why every business, particularly in the United States, should incorporate it into their due diligence procedures.

What is Adverse Media Screening?

Adverse media screening is the process of identifying negative news or content about individuals, organizations, or entities. This may include information related to financial fraud, terrorism, drug trafficking, human rights violations, and other predicate crimes. These checks are vital for companies that need to comply with Anti-Money Laundering (AML) laws and ensure that they are not unknowingly doing business with bad actors.

This process supports broader AML compliance strategies and is often combined with employee background checks and customer due diligence.

The Role of Adverse Media in AML Compliance

Adverse media screening is a critical part of AML compliance. Financial institutions and regulated businesses are required to monitor their clients and employees for links to criminal activity. In this context, adverse media screening services offer automated solutions to scan thousands of global sources in real-time. These include online news outlets, legal documents, watchlists, and social media platforms.

The use of adverse media screening tools is crucial for maintaining up-to-date risk profiles, particularly when dealing with politically exposed persons (PEPs) and high-risk jurisdictions. These tools help organizations avoid penalties, reputational damage, and operational risks.

Benefits of Adverse Media Screening Software

Modern adverse media screening software provides advanced capabilities that manual screening simply cannot match. Here are some key benefits:

Real-Time Monitoring

With automatic alerts, companies can react to emerging threats quickly. Real-time updates help compliance officers act immediately if new risk factors are identified.

Comprehensive Coverage

These platforms scan a wide range of sources globally, ensuring that nothing slips through the cracks—an essential feature in a digital age where news breaks instantly.

Cost and Time Efficiency

Automated tools reduce the time and resources required for manual reviews, allowing businesses to focus on core operations while still maintaining compliance.

Every 200 words, the keyword “adverse media screening” is naturally repeated, in line with SEO best practices.

Use Case: Employee Background Checks

Many companies use adverse media screening as part of their hiring process. While traditional background checks focus on criminal records, employment history, and education, they may miss reputational red flags. Adverse media monitoring fills this gap by scanning for any news articles or online mentions that may raise concerns about a potential hire.

For example, a financial services firm may run an employee background check using adverse media tools to ensure the individual has no past associations with money laundering or fraud.

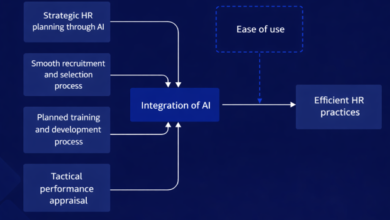

Integration with Other AML Tools

Adverse media screening doesn’t work in isolation. It often forms part of a broader AML solution that includes:

- KYC (Know Your Customer) verification

- PEP screening

- Sanctions list monitoring

- Transaction monitoring

By combining these tools, businesses create a layered defense strategy against financial crimes. This integrated approach improves accuracy and enhances compliance workflows.

The adverse media screening tool must be flexible, customizable, and capable of integrating with internal compliance systems for optimal results.

Choosing the Right Screening Tool

Selecting the right adverse media screening software involves evaluating several factors:

- Data coverage: Does it monitor global and local sources?

- Regulatory alignment: Is it compliant with U.S. AML laws?

- Usability: Is the dashboard user-friendly for compliance teams?

- Scalability: Can it handle thousands of customer profiles?

- Support: Is there strong customer service for ongoing assistance?

Businesses should also ensure that the vendor provides regular updates and maintains high data accuracy standards.

The Future of Adverse Media Monitoring

With advancements in artificial intelligence and natural language processing (NLP), adverse media screening is becoming more intelligent and predictive. Rather than just identifying known issues, AI-powered platforms can now flag potential risks based on trends, tone, and associations.

In a regulatory environment that increasingly demands real-time insight and transparency, the future of adverse media monitoring lies in automation, AI, and continuous improvement.

Conclusion

To stay compliant and protect their reputation, businesses must adopt a proactive approach to risk management. Adverse media screening is a vital part of this strategy, helping companies identify threats before they become liabilities. From onboarding clients to conducting employee background checks, these tools ensure your business is prepared for today’s complex compliance landscape.

By leveraging adverse media screening services, businesses not only meet regulatory obligations but also gain a competitive edge through trust and accountability.