AMTM Stock Outlook 2025: Performance, Forecast, and Investor Insights

The amtm stock has gained notable attention among investors looking for exposure to the defense, engineering, and government services sector. As global governments continue to invest in national security, infrastructure modernization, and advanced technologies, companies operating in this space are becoming increasingly relevant. AMTM stock represents a business positioned at the intersection of engineering expertise, technological innovation, and long-term government contracts, making it an attractive subject for both growth and stability-focused investors.

This article provides a comprehensive, easy-to-understand analysis of AMTM stock, covering its business model, performance drivers, risks, and future outlook.

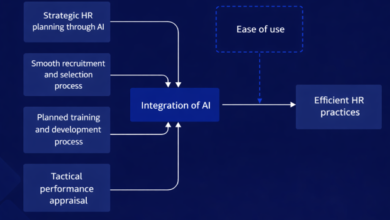

What Is AMTM Stock?

AMTM stock represents shares of a U.S.-based engineering and technology services company that primarily serves government and defense clients. The company focuses on mission-critical operations, including defense systems support, environmental solutions, intelligence services, and advanced engineering projects.

Core Business Areas

The company behind AMTM stock operates across several important sectors:

-

Defense and national security services

-

Engineering and infrastructure support

-

Environmental remediation and sustainability projects

-

Intelligence and cybersecurity solutions

These diversified operations allow the company to maintain resilience even during economic downturns.

Why Investors Are Watching AMTM Stock

Investors are paying attention to AMTM stock due to its strong positioning in government-funded projects, which often provide predictable revenue streams and long-term contracts.

Recent Performance of AMTM Stock

AMTM stock has shown solid price movement in recent months, reflecting growing investor confidence. While the stock has experienced normal market fluctuations, its overall trend indicates steady demand and improving sentiment.

Market Behavior

-

Moderate volatility compared to high-growth tech stocks

-

Consistent trading volume, indicating active investor interest

-

Gradual upward momentum supported by sector strength

Comparison with Industry Peers

When compared to similar defense and engineering service stocks, AMTM stock often stands out for its balanced growth potential and lower speculative risk.

Key Factors Driving AMTM Stock

Several fundamental factors influence the performance of AMTM stock.

Government Spending Trends

Government budgets for defense, infrastructure, and national security remain strong. This directly benefits companies like the one behind AMTM stock, as a large portion of revenue comes from public-sector contracts.

Long-Term Contracts

Multi-year contracts provide predictable cash flow and reduce earnings uncertainty. This stability is especially attractive to long-term investors.

Technological Innovation

The company continues to invest in advanced engineering and technology solutions, helping it remain competitive in a rapidly evolving defense and security landscape.

Financial Strength and Stability

Financial stability plays a crucial role in evaluating AMTM stock.

Revenue Consistency

The company demonstrates relatively stable revenue growth, supported by recurring government projects and contract renewals.

Profitability Outlook

While margins may not be as high as pure technology firms, profitability remains consistent, which is often preferred by conservative investors.

Balance Sheet Health

A manageable debt structure and steady cash flow enhance investor confidence in AMTM stock’s long-term sustainability.

Risks Associated with AMTM Stock

No investment is without risk, and AMTM stock is no exception.

Dependence on Government Contracts

A heavy reliance on government spending means policy changes or budget cuts could impact revenue.

Regulatory and Compliance Risks

Operating in defense and intelligence sectors involves strict regulations, which can increase operational costs.

Market Volatility

Broader market conditions, interest rate changes, and geopolitical events can still affect AMTM stock performance.

AMTM Stock Forecast and Future Outlook

The long-term outlook for AMTM stock appears cautiously optimistic.

Growth Expectations

-

Continued demand for defense and security services

-

Expansion into new engineering and environmental projects

-

Increased focus on technology-driven solutions

Analyst Sentiment

Market sentiment generally leans positive, with expectations of gradual price appreciation rather than explosive growth.

Long-Term Investment Potential

For investors seeking steady growth and exposure to government-backed industries, AMTM stock may offer a balanced opportunity.

Is AMTM Stock Suitable for You?

AMTM stock may appeal to:

-

Long-term investors seeking stability

-

Portfolio diversification into defense and engineering sectors

-

Investors looking for moderate growth with lower speculative risk

It may be less suitable for short-term traders seeking rapid price swings.

How to Analyze AMTM Stock Before Investing

Before investing, consider:

-

Overall market conditions

-

Government budget trends

-

Company earnings reports

-

Risk tolerance and investment horizon

Conducting personal research ensures alignment with your financial goals.

Quick Info About AMTM Stock

-

Sector: Defense and engineering services

-

Revenue Source: Primarily government contracts

-

Investment Style: Moderate growth with stability

-

Risk Level: Medium

FAQs About AMTM Stock

What does AMTM stock represent?

AMTM stock represents ownership in a company providing engineering and technology services mainly to government and defense sectors.

Is AMTM stock good for long-term investment?

AMTM stock can be suitable for long-term investors seeking stable growth supported by government contracts.

Does AMTM stock pay dividends?

Dividend policies may vary, so investors should review the company’s latest financial disclosures.

What affects the price of AMTM stock the most?

Government spending, contract wins, financial performance, and overall market sentiment are key factors.

Is AMTM stock high risk?

It carries moderate risk, primarily due to reliance on government budgets and regulatory environments.

Final Thoughts

AMTM stock represents a compelling option for investors interested in stable, government-backed industries. While it may not deliver rapid short-term gains, its steady performance, diversified operations, and long-term contracts position it well for sustainable growth. As always, aligning this investment with your personal strategy and risk tolerance is essential.